Are you planning to go to Rome for a few days of vacation this holiday season? Take note that the new tourist tax rates in effect until December 31, 2024, are in effect, all increasing, from +71% on vacation homes and 100% for room rentals. Smaller increases for classic accommodations: for hotels they range depending on the category to increases of +25 to +66 percent. The increases are expected to bring 48 million euros more revenue to municipal coffers. In 2019, the last year before Covid, 120 million was collected from the tourist tax. Increases that can be further increased by 2 euros by provincial capital municipalities for 2025, the year of the Jubilee of the Catholic Church, according to the Budget Law(as we have seen in this article). There are about 1,100 municipalities that provide tourist tax for visitors to their territory.

The Capitoline Council approved the new Tourist Tax rates, the Roma Capitale website explains, increasing them “based on the criteria of gradualness, types and classification of hotel and non-hotel accommodations.” In addition to hotels marked by ’stars,’ three categories have been introduced for Guest Houses and Room Rentals and two categories for Holiday Homes and Apartments. The new tariffs are implemented for all overnight stays “regardless of the time of reservation of the stay, as it is the time when the prerequisite of the Subsistence Contribution (overnight stay) is realized that is relevant.”

The new rates (approved by Resolution No. 255 of July 17, 2023) range from 4 euros for a night in a one-star hotel to 10 euros for a 5-star hotel, from 3.5 in a hostel to 6 in Bed and Breakfasts, Holiday Homes and Apartments - Category 1, Holiday Homes (basically the accommodation prerogative of religious institutions of various kinds, which are very common here) or Accommodations for tourist use (Art. 1, para. 2, lett. c and 12-bis of Lazio Reg. Regulation No. 8/2015, as amended) and intended for short-term rental (Art. 4, D.L. No. 50/2017, converted, with L. No. 96/2017). plus other various other types for all tastes and pockets.

The “Residence Contribution” (as the City of Rome calls it), we remind you, is per person per single night and is mandatory only for the first 10 consecutive nights in the calendar year in the same facility since its introduction. Responsible for the payment of the Subsistence Fee are the managers of the accommodations and those who collect or intervene in the payment of the fee or consideration due for short rentals, including those who engage in real estate brokerage activities and those who operate telematic portals by connecting people looking for a property with people who have real estate units to rent.

The previous rates had been in effect since 2014, and analyzing the increases we see that the largest are for the non-hotel sector, which has been booming over the past 10 years, with hoteliers seeing rates far removed from theirs that spoke of distorted competition on the tax side as well. With this new tabulation, therefore, an attempt is being made to reduce the distances and align the request for the contribution even for those who choose a house to rent on a site, because they ’consume’ the city in the same way as those who sleep in hotels. In the resolution in fact, it is worth remembering, it is argued the purpose of the subsistence contribution is to maintain the city for the use of tourists with the “growing need for services aimed at visitor reception, decorum and more generally public services,” such as transportation, waste management, security.

Compared to 2014, the percentage increases are +71 going from 3.5 euros per night to 6 euros for Holiday Homes and Apartments - Category 1, Holiday Homes, or Accommodations for tourist use, bed and breakfast, country house, guest house and room rentals category 2. For Room Rentals Category 1 the increase is 100 percent. One-star hotels go from 3 euros to 4 euros per day, 2-star hotels from 3 to 5 euros per day, 3-star hotels go from 4 euros to 6 euros, 4-star hotels from 6 to 7.5 euros, and for 5-star hotels it goes from 7 to 10. Children under 10 are exempt.

Naturally opposed are the managers of the facilities who protested when the resolution was passed. Starting with the sector’s most representative association: “At a time when Rome’s tourism is once again excelling,” argued Federalberghi-Confcommercio di Roma President Giuseppe Roscioli at the time of the Resolution’s approval, “it is absurd that the Municipality itself is proposing an initiative that can have no other effect than to bring it back down. For the past year, tourism in Rome has returned to creating employment, GDP and induced activity, surpassing every competitor also because of the exceptional effort of Councillor Onorato, aimed at bringing back to the city concerts and events of all kinds and enormous appeal.”

Assohotel-Confesercenti president Francesco Gatti stresses that his association was “for a realignment but certainly not for an increase for the high bands like the 4- and 5-star hotels that should already be brought back, at least, to a value in the European average. It is also recognized how the differences in taxation of the various hospitality players are even a source of market distortion by passively accepting their application without even vaguely thinking about their immediate realignment.”

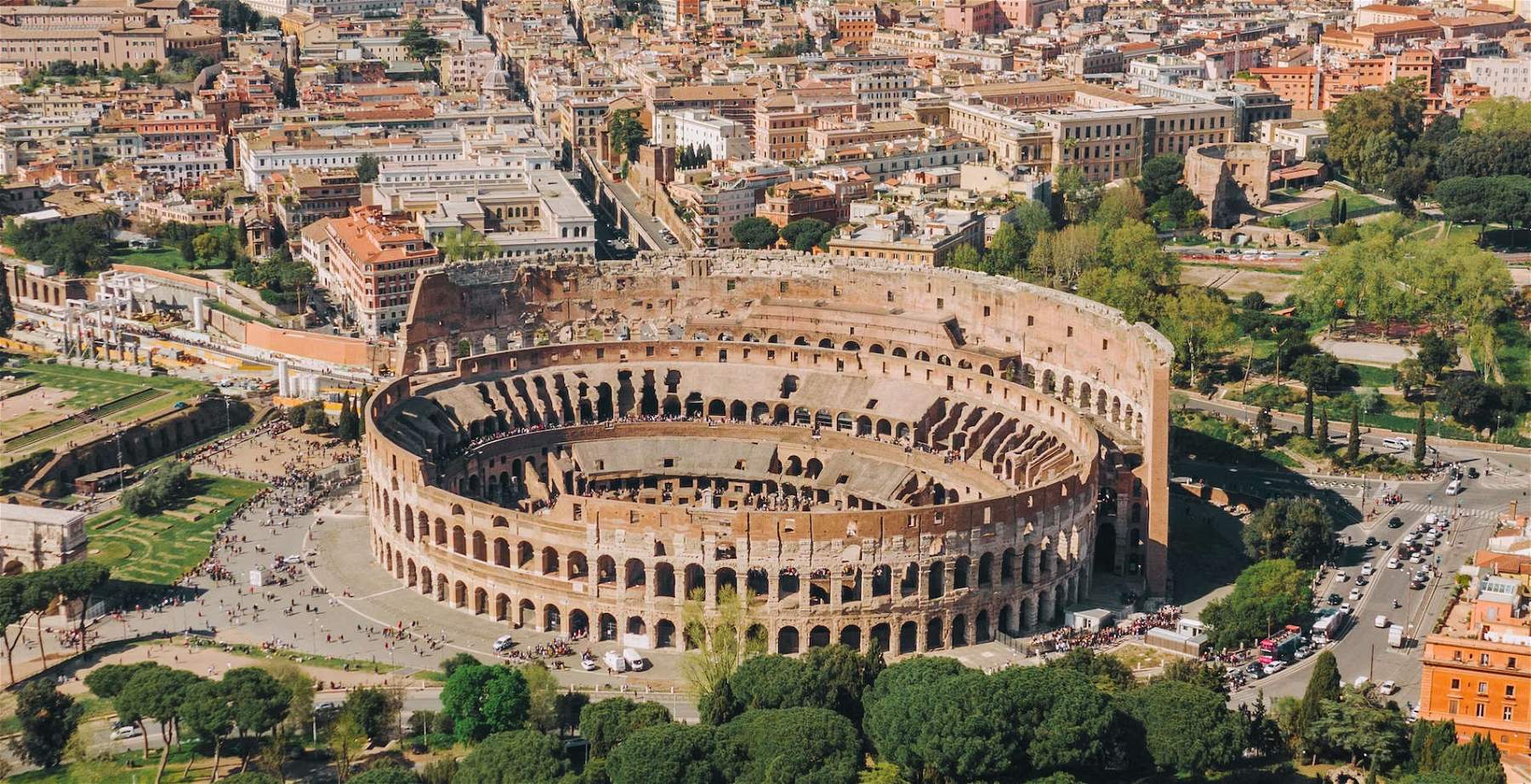

Image: view of Rome. Photo: Spencer Davis

|

| Vacations in Rome? Staggering increases in tourist tax |

The author of this article: Andrea Laratta

Giornalista. Amante della politica (militante), si interessa dei fenomeni generati dal turismo, dell’arte e della poesia. “Tutta la vita è teatro”.Warning: the translation into English of the original Italian article was created using automatic tools. We undertake to review all articles, but we do not guarantee the total absence of inaccuracies in the translation due to the program. You can find the original by clicking on the ITA button. If you find any mistake,please contact us.